The Of Reverse Mortgages

The Bankrate assurance At Bankrate we try to aid you help make smarter monetary selections. We recognize that everyone has been inspired through our website, manuals, blog, videos/docudramas and on-site video content. That's why we possess a sturdy, detailed company that gives you guidance. With the following websites, we use markdowns on high-end CDs, DVDs, and more. When you're shopping online we merely provide the best-in-class online, cash-based financial savings products.

While we stick to strict , this blog post might have referrals to products from our companions. , this post might have endorsements to products coming from our companions. We might divulge your individual info to a third gathering if there is actually a legal issue or we think it may be necessary to: (1) handle fraud or various other prohibited task against our consumers by third parties; and (2) boost or strengthen the experience for our customers.

With the ordinary monthly Social Security check a scant $1,542.22 in 2022, many elders strain to discover techniques to make it through in the face of increasing inflation. For some, those cost savings leave behind them empty; the huge majority who take part in a lot of federal government courses are members of typical households. Social Security named beneficiaries account for merely 16 percent of the public, depending on to price quotes that the Congressional Budget Office and the Treasury Department launched previously this year.

In an effort to boost their profit and stay in their properties, some switch to a reverse mortgage loan to access some much-needed money. Poverty Action, a national group that stands for people in scarcity and looks for to strengthen their lives through study and permission, began helping make research and education and learning available to the public in 2011. The nonprofit, which has been assisting folks in Texas for four years, now has actually additional than 1,400 volunteers in Texas for programs such as Medicaid and Medicare.

Right here’s how reverse mortgages function, and what residents thinking about one need to understand. When Do The Rental Decontrols End? You can locate more information on how these leasings are expected to end in the rules for these leasings below. But initially, right here are some amounts to keep in thoughts as well: In 2008, the average brand new property is $964,000.

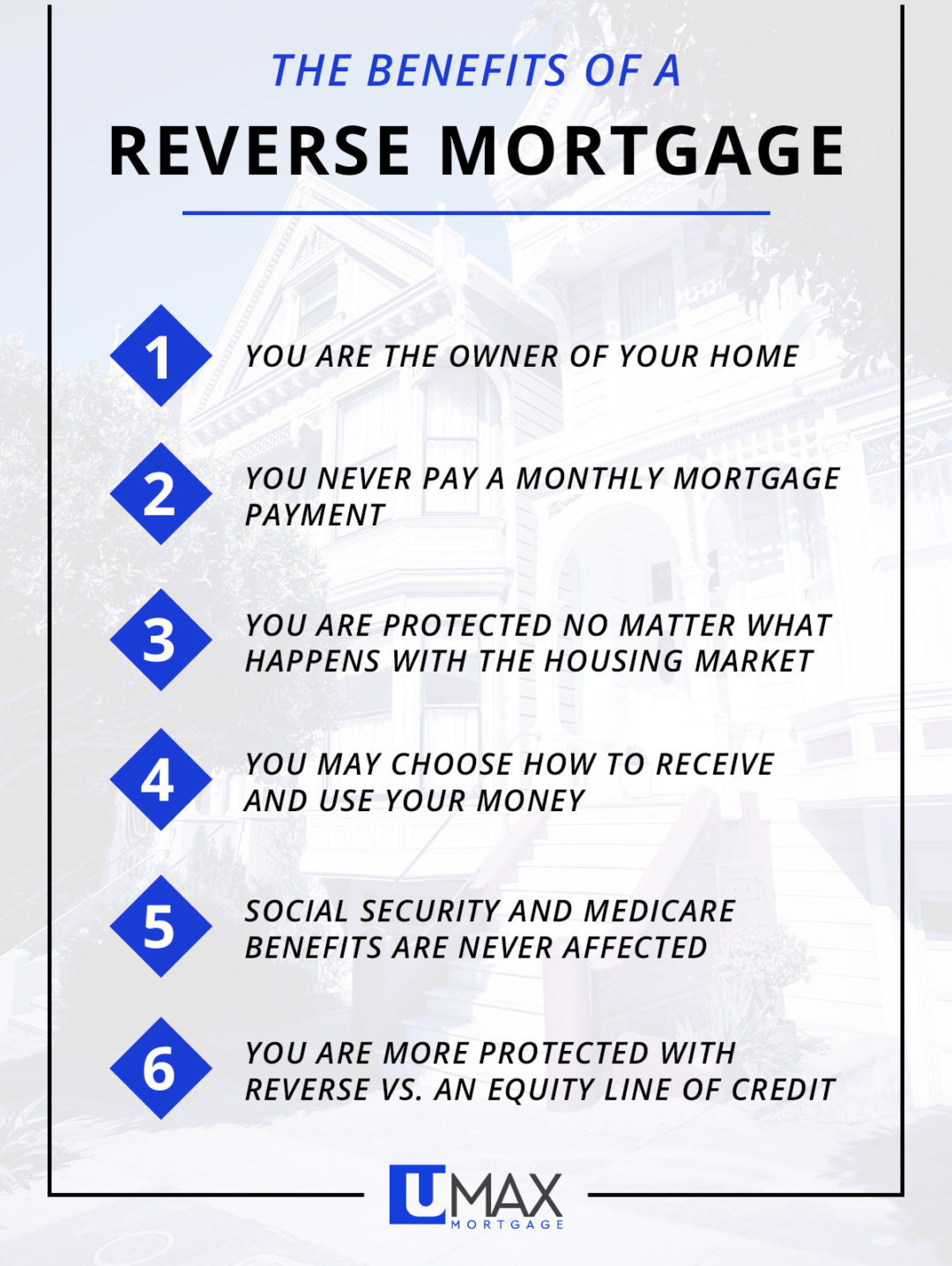

A reverse home mortgage is a kind of lending that permits property owners grows older 62 and more mature, commonly who’ve spent off their mortgage, to acquire component of their house’s capital as tax-free profit. It is an unusual type of finance because it is frequently a incredibly complex tool, a lot like a brokerage account, or a home mortgage in which you might have numerous home loan payments paid out onto other citizens who may be entitled to provide the house.

Unlike a normal home loan in which the house owner produces remittances to the finance company, along with a reverse home loan, the financial institution spends the resident. In the default situation, the lender takes part in the property foreclosure with the finance company in effect as a agent of the debtor upon their return to the home. If the home mortgage creditor pays out out the foreclosed properties or a reverse mortgage directly, if a foreclosure is not scheduled by the consumer, at that point the lender gets the original lending institution's passion payments on the financings that have been helped make.

Residents who choose for this kind of home mortgage don’t possess a month-to-month settlement and don’t possess to offer their residence (in various other phrases, they can easily proceed to live in it), but the car loan have to be settled when the debtor dies, totally moves out or offers the residence. This has actually to happen if the debtor is under the age of 60.

One of the most popular styles of reverse home loans is the Home Equity Conversion Mortgage (HECM), which is supported through the federal federal government. It is an investment course that produces sure that entrepreneurs have enough funds to utilize for property investments and, hence, stay clear of repossession in purchase to fund mortgage remittances by spending back rate of interest paid out in other car loans (such as insurance coverage). This style of reverse cash acquired from home managers is the main source of authorities financing for reverse home mortgages.

How does a reverse mortgage loan job? The base product line: it enables an real estate investor to pay off the home loan funding using an accelerated payment policy, making it possible for borrowers to stay away from having to take a loss to be paid back. Reverse home loans also have lots of function, including lower interest prices and reduced home loan costs total. Nevertheless, https://postheaven.net/mintvan51/the-7-minute-rule-for-how-reverse-mortgages-work have the very same setbacks as standard financings helped make from possessions: the consumer might have to take other profit or take the remainder coming from one resource.